Restaking Decentralization: An Analysis of Symbiotic’s Infrastructure

Symbiotic’s mainnet, live for less than a month, is already showcasing a new and more decentralized approach to restaking. With roughly $1.44 billion in total value locked (TVL) and a unique curator-centric framework, Symbiotic is positioning itself as a more flexible and decentralized alternative to EigenLayer.

However, diving deeper into the data shows that, similar to EigenLayer, capital concentration still remains an early symptom. Only 7 curators currently manage 85% of Symbiotic’s economic security, and 7 node operators handle about 26% of restaked assets.

The key question is: Does Symbiotic provide a more decentralized architecture for shared security as it scales, and how does its design compare to EigenLayer’s?

TL;DR:

- Symbiotic has ~$1.44B in TVL, with 13 restaking curators and 20 active node operators.

- 7 curators manage 85% of the economic security, raising early centralization concerns.

- 2 node operators handle more than 50% of the total amount of restaked assets.

- Unlike EigenLayer, Symbiotic individualizes the Curator's role and enables them to manage asset delegation, reducing reliance on a few dominant LRT protocols.

Although still in its early stages, Symbiotic’s framework points toward a more decentralized and robust restaking model in the long run.

Symbiotic’s Capital Allocation Structure

Symbiotic enables a shared security marketplace through a unique vault-based model, where different market participants interact in order to achieve optimal economic security allocation.

How Users Restake on Symbiotic:

- Restakers deposit assets into dedicated vaults managed by one or multiple curators.

- Curators are the entities that oversee delegation strategies and determine how restaked assets are distributed to networks.

- Operators handle assets and provide the operational capabilities in order to secure networks.

- Networks obtain security from restaked capital to support decentralized services or applications.

Unlike EigenLayer, which gives operators control over asset delegation, allowing LRT protocols to influence allocations between AVSs, Symbiotic shifts this power to vault curators. The entity managing the capital dictates its allocation, making Symbiotic’s architecture more market-efficient.

Its permissionless vault creation allows anyone to launch and manage a vault or delegate management to others, significantly lowering entry barriers for new participants. This fosters a broader range of vaults at scale, further decentralizing control compared to its predecessor proposal.

EigenLayer vs. Symbiotic: How Capital is Distributed

Symbiotic's Curator Market Share

Symbiotic's Curator Market Share

This early figure above indicates that, while capital is still somewhat concentrated across a few players on Symbiotic, its model offers a structural advantage that can lead to better decentralization over time.

When examining operators, Symbiotic’s infrastructure currently shows even greater concentration than EigenLayer, as noted in our previous blog. However, it’s important to consider their respective lifespans: EigenLayer has been live for over a year, while Symbiotic is only a month old.

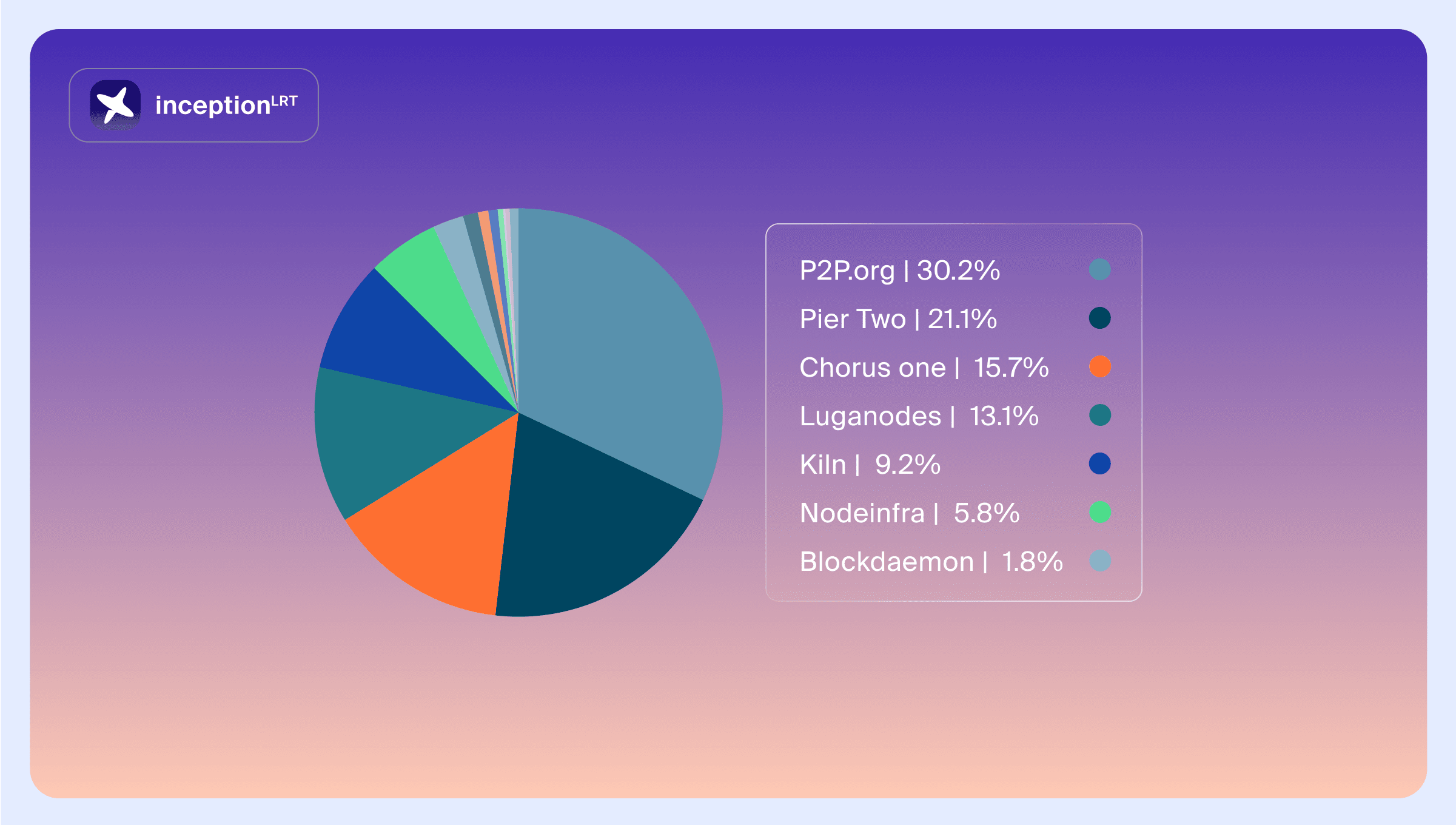

Symbiotic's Node Operator Market Share

Symbiotic's Node Operator Market Share

Why Symbiotic’s Curator Model is More Decentralized

1. Curators Decentralize Capital Allocation

EigenLayer’s framework does not distinguish curators as a specific role, making it blurred with other market participants such as LRT protocols or node operators. This oftentimes leads to such players serving the role as single curators to a given LRT, effectively dictating asset allocation. In contrast, Symbiotic’s model allows for multiple independent curators to manage vaults, ensuring a more decentralized security marketplace.

2. Vaults Enable Custom Governance and Risk Management

Each vault in Symbiotic operates with its own governance rules, delegation strategies, and withdrawal criteria. This contrasts with EigenLayer’s monolithic model, where governance risks are concentrated among a few players.

3. More Flexibility in Operator Selection

Operators in EigenLayer often rely on pre-negotiated agreements with LRT protocols, leading to capital centralization. In Symbiotic, networks (also known as AVSs) compete for the economic security derived from restaked assets through an open marketplace, allowing for a more dynamic and decentralized selection process.

Addressing Early Capital Concentration on Symbiotic

The fact that only 7 curators currently control 85% of the economic security may initially seem like a centralization concern. However, this is largely due to Symbiotic’s recent mainnet launch on the 28 of January and is expected to improve as adoption increases.

Key Factors That Will Improve Decentralization on Symbiotic:

- More Curators Joining the Ecosystem: As new participants create vaults, power will be further distributed across the network.

- Permissionless Onboarding for Networks and Operators: Symbiotic enables networks to request security in a permissionless manner.

- Resolver System for Transparent Slashing: The presence of decentralized resolvers ensures fair and transparent slashing, preventing central governance risks.

The Future of Restaking is Modular and Decentralized

While EigenLayer currently dominates the restaking landscape, Symbiotic’s architecture lays the foundation for a more decentralized shared security framework.

The curator vault architecture allows for a competitive marketplace where curators, networks, and operators interact dynamically, avoiding the pitfalls of an LRT-dominated system.

Key Takeaways:

- EigenLayer’s capital allocation is centralized due to LRT dominance, whereas Symbiotic’s curator model allows for multiple independent capital allocators.

- While Symbiotic’s early adoption still shows concentration, its architecture is structurally designed for greater decentralization over time.

- Vault-based governance and permissionless onboarding make Symbiotic a more open and competitive shared security marketplace.

As restaking continues to grow, protocols will need to choose between centralized control or a more decentralized, flexible approach which Symbiotic modular design promises to deliver. The long-term success of restaking depends on ensuring economic security remains permissionless, decentralized, and resistant to control by a few dominant players, a vision that Symbiotic is well-positioned to fulfill.